Cash flow management is important for any business — but it’s especially important for bootstrapped startups.

The bootstrapping model is a solid and sustainable way to launch and grow. It’s been a choice for all kinds of companies, from Shopify to GoPro and even our team at Bubble.

But when you’re bootstrapping your company, you need to work with the actual cash you have. You’ll need to grow your audience faster to increase revenue before you can scale.

You’ll have more stability and better control of your company when you’re able to maintain a positive cash flow.

Cash flow basics

Cash flow refers to how much cash comes in and goes out of your business over a given period (i.e., a month, quarter, or a year). Positive cash flow means you have more money coming in than going out. Negative cash flow means you’re spending more money than you’re taking in.

Most business owners are already tracking their revenue to measure financial health. However, cash flow is another important metric that differs from revenue in a few important ways:

- Revenue is a record of how much money you’ve made in a given period. Cash flow is a record of both money made and operating expenses. Your revenue will generally be higher than your cash flow, since revenue doesn’t reflect spending (as such, it can be a deceiving way to measure financial health).

- Revenue looks at total money made during a given time. Cash flow looks at the amount of cash into your bank account during that same time. (For example, if you’ve invoiced a client but haven’t been paid yet, that counts toward revenue, but not cash flow.)

Let’s look at an example:

Let’s say your revenue for the month is 12,000. Of that invoiced revenue, at the end of the month, you’ve only been paid $6,000. If you have $4,500 in operating expenses and bills paid that month, your cash inflow — new cash in the business — is only $1,500, even though your revenue is $12,000.

A healthy cash flow is positive: Your cash inflows are greater than your cash outflows. After paying all of your expenses and bills, you still want to have cash left over.

Positive cash flow is especially important for bootstrapped businesses. When you’re funding your business yourself, you’ll likely feel even more pressure and uncertainty around keeping your business afloat and making sure you can make ends meet. Since you’re taking risks with your personal finances to finance your business, you need to carefully track your business health to protect both your startup and yourself.

Implementing cash flow management techniques gives you a lot more security for your business and reduces that risk and uncertainty.

How to manage cash flow

Proper cash flow management has three main components:

- Forecasting your cash flow

- Tracking cash flow

- Responding and adjusting based on your tracked results

Forecast

Clear cash flow projections help you understand what you’re expecting to bring in and your current status.

The core numbers to know are:

- Your current funds: how much cash you have “on hand”

- Projected costs: a realistic estimate of your projected costs for the upcoming month or quarter

- Projected income: a realistic estimate of your projected income for the upcoming month or quarter

Your projected income should include all cash flow, not just revenue. For example, if you’re expecting a business loan to get approved in the next month, that should be included in your projected income.

Creating a cash flow forecast helps you plan for future expenses. You can see in advance where you might need to delay payments, get paid sooner, take out a loan, raise funding, or make other adjustments to manage a healthy cash flow.

Track

Tracking cash flow regularly makes sure you stay aligned with your plan and can make adjustments as needed.

A cash flow budget or a cash flow statement is the best way to track your cash inflows and outflows.

For your cash flow statement, you can use either direct tracking or indirect tracking.

Indirect tracking takes your net income for a period and then subtracts all expenses from it to calculate the amount of cash you have on hand. This method is easier but doesn’t give you as much detail on where your cash is coming from or going.

Direct tracking lists all of your income sources and expenses for the period. This gives you a better picture of exactly where your cash is coming from and going. It’s a much better option for understanding how to improve your cash flow, but it does take more time and effort.

Your cash flow statements should look at actual payments and cash inflows, not revenue or invoices. If you’ve invoiced for a service or earned revenue that hasn’t yet been paid, that’s not cash on hand and shouldn’t be included.

Many companies sort out cash flow on their income statement from three sources: operations, investing, and financing.

- Cash flow from operations measures the amount of money moving in and out of the business related to your operating activities, i.e., income and revenue.

- Cash flow from investing measures the amount of money moving through your business due to buying and selling long-term assets and investments. This could be things like buying or selling property or equipment, business acquisitions, or other investments.

- Cash flow from financing measures the amount of money moving through your business due to financing, such as loans, new credit lines, paying off debt, or so on.

Tracking each of these separately on your cash flow statements gives you a clearer understanding of your current financial health as well as your future cash flow.

Respond

When you’re regularly tracking and monitoring cash flow, you can better identify cash flow problems early on and address them appropriately to avoid real cash flow issues.

How you respond depends on your projections and forecast, as well as where the issue is stemming from. A good accountant can help you manage cash flow analysis as well as avoid a cash flow crisis.

How to improve cash flow

There are just two basic ways to increase cash flow: increase the cash coming in, or decrease the cash going out.

Unfortunately, that’s a lot easier said than done.

Fortunately, there are plenty of different techniques you can use to increase cash inflows or decrease cash outflows.

Be cautious with growth and prioritize profitability

Another way to protect your cash flow is to grow carefully. A “growth at all costs” mentality may seem beneficial, but can be disastrous for your cash flow and your bottom line.

When you’re bootstrapping, you have to be especially careful to prioritize profit from the beginning. Profit is the amount of revenue left in your business after you’ve paid all of your expenses.

Growing quickly early on often requires high spending and more investment into resources. At the same time, when you’re spending a lot on growth, it may be some time before your sales catches up to your spending, which can be risky and certainly makes it hard to sustain a healthy cash flow.

Instead, aim for a slow and steady growth rate that keeps your cash inflow and outflow in mind.

Increase immediate revenue

Increasing immediate revenue is one of the most basic ways to generate positive cash flow. Immediate revenue is revenue that’s received as soon as the product or service is delivered.

The core ways to do this are:

- Increase your number of customers

- Increase the amount of your average sale

- Increase the frequency of customer purchases

- Increase the price of your product or services

Thinking of cash flow and revenue in these terms makes it easier to figure out exactly what you can do to increase revenue.

While increasing prices is pretty straightforward (at least on the surface), increasing revenue in other ways is often more opaque. Here’s a few ways to make it possible.

Focus on your customer first

Early on in your startup, it can be incredibly effective to focus outsized energy on your customer needs and wants.

This will help you create a loyal customer base and strong product-market fit. Over time, this will increase the number and frequency of your customers’ purchases, and grow your audience over time. Great product-market fit early-on can also help increase word-of-mouth marketing and positive reviews among your target audience, which in turn becomes a flywheel of marketing and growth.

Shipping an MVP (minimum viable product) first and then testing and iterating based on audience feedback is a great way to do this practically. If you’re building on Bubble, you can iterate and ship updates directly from your MVP, making it even easier to find what your audience wants and build it for them.

Focus on what’s making money

While it’s tempting to want to expand quickly early on, focusing first on the most effective revenue generators is a better way to improve cash flow in the short term.

While building Bubble, co-founders Josh and Emmanuel bootstrapped for seven years before raising outside funds to better focus on expanding the functionality of the product to meet user needs. Many investors wanted them to “niche down” and focus on a specific vertical. But the element of Bubble that many early customers loved was the flexibility and ability to build absolutely anything.

This is relevant for other business models, too. For example, a skincare company that makes amazing sunscreen may be tempted to quickly expand into makeup, lotions, and other skincare products. However, by instead focusing on making their initial product that customers love perfect (or close to it), they can build a loyal customer base and be known first for their amazing sunscreen, before moving onto other products, which will take time and resources to get right.

In short: Don’t dilute your current products by expanding into new ones.

Using a direct reporting method on your cash flow statement can make it easier to drill down on what’s working and where to focus on your energy when it comes to operating activities. You’ll easily spot where most of the money is coming in.

Adjust your pricing model

Adjusting your pricing model can make it easier to receive income more regularly, even if the revenue doesn’t change. Can you get paid earlier, more regularly, or more upfront?

For example, you could consider:

- If you’re a service business, setting shorter payment terms will shorten the gap between invoicing and cash inflow.

- Offering more payment options makes it easier for customers or clients to pay you more quickly. For example, you might choose to accept credit card payments as well as cash options, or you might allow customers to pay in installments, allowing them to make a larger purchase than they otherwise might have. Of course, these alternate payment models will cost money to service, so make sure it’s not a wash before you offer them.

- Setting flexible payment terms. For example, allowing customers to choose if they want to pay for subscriptions monthly or annually can distribute your cash flow more evenly and make it easier to keep healthy cash inflows. You could also consider discounts for products purchased on subscription vs. one-off purchases, increasing your annual recurring revenue.

- Set up early payment discounts to encourage clients to pay invoices more quickly.

Stay on top of invoicing and accounts receivable

The faster you invoice a client, the faster you can get paid.

Of course, it’s a good idea to set upfront payment terms with clients so you can know when to expect that payment. Many businesses work on net 30 or net 60 payment terms. If you’ve both agreed on payment terms, you should have a better idea of what that cash inflow will hit your accounts.

From there, manage your invoicing at a reasonable frequency, at least weekly. At the same time, keep an eye on your accounts receivable. Accounts receivable is the place to track what money is owed you that hasn’t yet been paid.

For example, if you invoice a client for $4,400 but they haven’t paid yet, that goes into your accounts receivable. You know that cash is coming your way, but it’s not yet cash in hand.

Managing your accounts receivable closely allows you to maintain a healthier cash flow by avoiding spending money that you’ve invoiced for but not yet received.

Decrease spend

Aside from increasing incoming cash, decreasing the amount of cash going out of your business can also help you reduce tight cash flow margins.

Cost-conscious decision-making

Especially in the early stages of your business, making decisions with cash inflows and outflows in mind can go a long way to support cash flow management. Ultimately, it comes down to the old adage, “don’t spend what you don’t have.” For bootstrapped companies, this is key. After all, increasing your revenue isn’t always immediately within your control — cutting costs is.

For example, you might keep an eye on spend by:

- Opting for a coworking space for your small team rather than having a dedicated office. Or, set up a fully remote team and provide a stipend for home offices or coworking spaces instead of paying expensive office leases.

- Using a no-code development platform instead of hiring an entire development team. No-code tools require far less resources and investment and allow you to move faster with fewer startup costs.

- Hiring generalists or work with contractors instead of immediately hiring full-time staff. As your startup grows, you want people who can grow and shift with your changing needs. Generalists and contractors allow you more flexibility and can reduce your overall spend on resources.

If you need to cut costs quickly and immediately to increase your runway, or manage a major upcoming expense, you could consider:

- Consolidating your software subscriptions. It’s so easy for many companies to subscribe to more software or SaaS products than are truly needed. Do an audit of your current software subscriptions and see where you can cut or consolidate (i.e., if you have access to Google Meet, do you really need a Zoom subscription as well?)

- DIY more work. If you’re currently outsourcing certain aspects of your business, see if it’s something you can manage on your own for a time to save money. For example, you might be outsourcing web design or product development, but you might be able to build your website or product on Bubble instead and save thousands. Or, you might be outsourcing marketing and sales, when you could lean more heavily on referrals and word-of-mouth for a time.

Lease instead of buy

This goes for equipment as well as software and other business expenses. When you lease first instead of buying, you give yourself more flexibility alongside freeing up cash.

For example, managing a monthly payment for software instead of making an expensive upfront payment for licenses allows you to make a smaller impact on your cash flow without sacrificing tools or resources.

Same goes for equipment and other business expenses. Leasing when possible gives you more flexibility to move in a different direction or upgrade as needed in the future, without being tied into a previous decision.

Refinance debt

If you’re spending a significant portion of your monthly income on debts, consider refinancing to make your monthly payments more manageable and free up some of your cash.

A good accountant can help you figure out how to manage this best. As an example, though, if you have a high interest rate on your business credit card, it may be worth taking out a small business loan to pay off that credit card debt and then paying the lower-interest business loan back instead.

Keep an emergency cash reserve on hand if possible

A cash reserve — ideally at least three months of expenses — is a good idea for your personal life, and a must for your business.

Having a cash reserve allows you to have more flexibility and agility with your finances and spend without getting into a precarious position. A business credit card or other lines of credit can give you more flexibility for short-term expenses, especially if you’re still growing and your cash inflow is inconsistent.

In short: Backup cash, whether it’s savings in your bank account or a line of credit, can give you stability and security as you grow.

Seek other funding methods

Of course, revenue from operations isn’t the only way to increase your cash inflows. Other funding methods can give you a cash runway that enables you to focus on growth while maintaining positive cash flows.

There are plenty of funding methods available that can immediately improve your operating cash flow.

A business loan or business credit card are two options, but these can also be risky.

If you’ve built an audience while bootstrapping, crowdfunding can be an effective method of raising cash even while still building and launching your product.

Bootstrap your app on Bubble

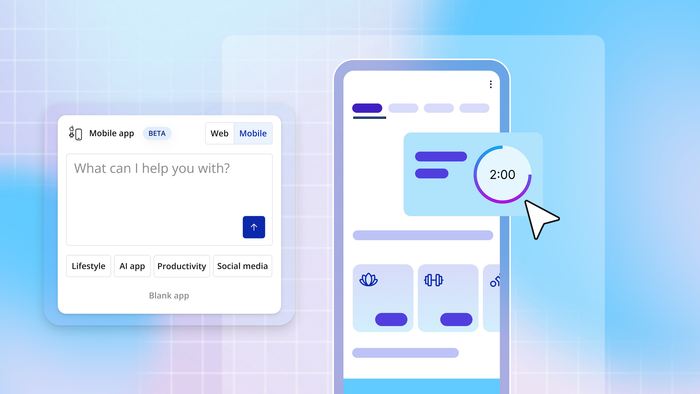

A no-code development platform like Bubble makes it a lot easier to bootstrap your app by decreasing your expenses on resources and software.

With no-code tools like Bubble, you can build much faster, with fewer resources, so you don’t need to hire an entire development team — one or two dedicated developers will do, or you can even build it yourself!

Even better: Since Bubble makes it much faster and easier to build and launch your web or mobile app, you can grow your audience (and start generating revenue) sooner.

If you’re bootstrapping your app and looking for more ways to manage your business’s cash flow, no-code development can help you reduce expenses while growing your audience faster to increase revenue.

Build for as long as you want on the Free plan. Only upgrade when you're ready to launch.

Join Bubble