27+ SaaS Stats Startup Founders Need to Know: Market Growth, Usage, and More

One statistic doesn’t tell the whole story — but a whole bunch of them can do a better job.

If you’re curious about the state of the SaaS (Software-as-a-Service) industry in 2024, including:

- SaaS growth over the past several years

- SaaS spend and usage

- Effective SaaS marketing

- Starting and growing a SaaS startup

Then these SaaS industry statistics from recent years will give you a better understanding of SaaS trends, growth, and how to grow your SaaS startup.

Top SaaS statistics and trends

- Spending on cloud-based services is expected to surpass one trillion dollars by the end of the decade.

- 92% of business leaders said they were planning to or are likely to purchase AI-powered software in 2024.

- SaaS spend per employee now averages $5,607, up 7% from 2023.

- 23% of IT leaders said their biggest priority in 2024 was to automate more SaaS management.

- 52% of business leaders said SaaS budgets are tighter than before.

- 49% of buyers said cost was the most important factor when choosing SaaS applications.

SaaS statistics and growth statistics

TL; DR: The global SaaS market is growing. Here’s a look at some of the top numbers.

Worldwide user spending on cloud services is forecast to grow 20.4% to a total of $675.4 billion by the end of 2024

According to a report from Gartner, spending on cloud services such as SaaS platforms and other cloud-based SaaS apps is rising. Total growth in 2024 is expected to be up 20% YoY. Gartner attributes this to two major factors: the growth of generative AI models and tools and the continued modernization of apps and tools in the workplace. As more teams continue to rely on cloud-based software versus traditional hardware and software purchases, demand for SaaS products grows. And now, with the advent of generative AI and more AI-based products and tools to improve business processes, AI-based SaaS tools are continuing to drive growth in the SaaS market.

In the same report, Gartner forecasts that public spending on cloud-based services will exceed one trillion dollars by the end of this decade.

For SaaS companies, the median growth rate by ARR in 2023 was 30%

Growth rates by ARR (Annual Recurring Revenue) depend greatly on the size of your SaaS company. Overall, while SaaS growth appears to be slowing somewhat compared to previous years, the SaaS industry and companies are still growing overall.

For 2023, here’s the average growth rates reported by companies of varying sizes:

- 59% growth for companies with ARR <$1 million

- 35% growth for companies with ARR $1 million to $5 million

- 30% growth for companies with ARR $5 million to $10 million

- 25% growth for companies with ARR $10 million to $20 million

- 22% growth for companies with ARR >$22 million

These growth rates all show some decline from 2022, except smaller SaaS companies, which are seeing increased growth.

Growth rates also vary based on company funding or ideal customer type.

Bootstrapped and equity-backed companies are both seeing slowed growth rates compared to 2022, with 25% and 30% growth respectively in 2023.

Further, SaaS companies targeting enterprise buyers in 2024 saw the highest growth rates, averaging around 26%. On the flip side, those targeting:

- Mid-market businesses saw growth rates of around 22%

- Small businesses saw growth rates of around 12%

- Consumers saw growth rates of around 5%

The takeaway: While growth may be slowing somewhat YoY, many SaaS companies and the industry overall are still experiencing healthy growth. Also, growth rates vary widely between companies based on company size, funding status, target audience, and more.

Comparing growth rates between similar companies to your own can be helpful, but a SaaS company can see a much lower growth rate than average and still be a leader among its target market depending on growth stage and audience.

The US is leading the SaaS global market in terms of SaaS revenue and number of SaaS companies

With over 15,000 SaaS companies based in the US — and over $155 billion in SaaS revenue coming from the US market — the US leads the way in terms of SaaS market growth. The UK, Canada, India, Germany, and France, respectively, come up next for a number of SaaS companies.

The fastest-growing SaaS categories in 2024 are customer support tools, DevOps, and HR platforms

According to research from Q1 2024, the highest-growing categories in new purchases for SaaS solutions (compared to renewals) were:

- Customer support tools (+100%)

- DevOps tools (+90%)

- HR platforms (+133%)

One reason could be the growing AI capabilities available in many of these tools, offering more productivity, automation, and streamlined processes.

SaaS spend per employee now averages $5,607, a 7% increase from 2023

Although growth is slowing, spending per employee on SaaS applications continues to increase. This could be the result of many factors. For one, many SaaS software is increasing in cost on the whole. Another possibility: an increased focus on AI tools and AI-embedded tools, which are typically more expensive.

SaaS usage stats

Growth may not have been off the charts in 2024, but that doesn’t mean that SaaS usage isn’t still a staple of the modern work environment.

52% of buyers said “productivity improvements” were the reason they purchased new SaaS applications in 2024

Call it the rise of AI, the shrinkage of internal teams, or a general “do more with less” mindset — productivity gains are the most common reason teams or individuals purchase SaaS tools.

Following just behind:

- Concerns about cybersecurity (47% of buyers)

- New needs outgrew existing solutions (43% of buyers)

On average, public SaaS companies have about 36,000 customers

Fewer than you thought?

You may not need as many customers as you think to build a healthy and sustainable ARR. On the flip side — even some of the largest SaaS companies haven’t hit the upper limit on the Total Addressable Market (TAM).

Although growth has slowed slightly, there’s still plenty of room in the SaaS market for newcomers — and for expanded market growth for existing brands as well.

The number of SaaS apps used by each team or department within a company grew by 14% in 2023, to an average of 73 SaaS apps per team

Although the speed of growth is slowing somewhat, the number of apps used by each team at the departmental level continues to grow (i.e., an average of 73 apps per team in 2023, compared to an average of 64 apps per team in 2022).

The number of company-wide SaaS apps dropped in 2023 by 14%

On the other hand, as the number of departmental SaaS apps used continues to increase, company-wide SaaS portfolios have decreased slightly.

This is likely due to more conservative budgets and stronger governance over SaaS adoption and purchasing. In a 2024 survey, 44% of IT leaders said they’d been asked to reduce SaaS spending. In addition:

- Apps identified as “shadow IT” dropped from 53% to 48% in 2023, suggesting that IT teams are increasingly reducing unauthorized SaaS programs and tools and unused apps to reduce “SaaS sprawl.”

- 53% of organizations in 2024 reported they’ve eliminated duplicate SaaS business apps to reduce spend (up from 40% the previous year).

Don’t panic, though — even though company-wide SaaS growth might have cooled slightly, there’s been a 1300% increase in SaaS apps used company-wide since 2015 — so the SaaS industry isn’t going anywhere.

SaaS marketing stats

Effective SaaS marketing isn’t always obvious — here’s what’s working and what to keep in mind as a SaaS founder.

On average, the software buying committee is made up of five people

SaaS businesses targeting SMBs and enterprises are rarely selling to just one person — you’re almost always selling to a team of decision makers. More specifically:

- 33% of the time there are 2–3 people involved

- 32% of the time are 4–6 people involved

- 14% of the time there are 7–10 people involved

And the finance team is almost always involved as well — 77% of buyers said finance was involved all or most of the time.

Moral of the story: Don’t narrow down your marketing too much. Consider all of the stakeholders and buyers that will be involved and their needs and desires — whether they’re trying to save time, money, effort, or something else.

47% of SaaS companies that require a credit card for a free trial see 50% or higher conversion rates

To require or not require a credit card for free trials? With this data, it’s no longer really a question.

47% of SaaS companies that require a credit card for a free trial see conversion rates of at least 50%, compared to only 10% of companies who don’t.

Put another way: When SaaS providers require a credit card for the free trial, about half of them see at least half of their free trials convert to paid plans. When they don’t require a credit card, only about 10% of companies see the same results.

When no credit card is required for the trial, 68% of companies see 20% or less of free trials convert to a paid plan.

SaaS buying cycles increased by 16 days YoY in 2024

If you’re selling SaaS, you may have noticed this yourself. According to data from Q2 2024, buying cycles took, on average, 16 days longer for new software purchases compared to Q2 2023.

The consensus on the cause? Why else: AI.

The AI SaaS market is driving a lot of the new growth, demand, and urgency in SaaS tools right now — but AI products tend to be more expensive than other SaaS services, and take 21% longer to buy on average. Add to that stricter governance and budgets, and it makes sense that we’re going to start seeing longer buying cycles overall.

65% of startup founders said word-of-mouth was one of their highest-impact marketing activities

In a survey of startup founders, word-of-mouth marketing came out on top as the highest-impact marketing activities. Also leading the way:

- Search engine optimization (SEO) (65%)

- Cold outreach (46%)

- Content marketing (45%)

- Email marketing (35%)

- Social media (34%)

- Conferences and trade shows (32%)

Worth noting: Although many of these are often considered “free” or “organic” marketing channels, it takes consistent input, effort, and investment to do these well and see the benefit.

Also worth noting: Most of these are “owned” channels that help you build an audience without having to continually invest in ad spend or marketing budget, which can help make your marketing more effective over time.

49% of SaaS buyers say cost is the most important factor when choosing a solution

Budgets and spending may be up, but that doesn’t mean that cost isn’t a factor. In fact, for about half of buyers, it’s one of the most important factors when making a final decision on what SaaS tools to use.

Other top factors include security (48%) and features or functionality (40%).

Interestingly, cost and security ranked above more traditional differentiators such as features, ease of use, and integrations. Of course, those factors matter, too. After all, if your product can’t solve their problems, it won’t even be in the running.

The takeaway: With so many similar SaaS products on the market today, don’t overlook prioritizing “utilitarian” factors like cost and security in your marketing and on your website alongside showing off those fancy new features you built.

SaaS startup and founder stats

If you’re a SaaS founder launching and growing a startup — or looking to do so — you might be curious how other founders are doing it, what’s working, and what’s not. Here are some key stats to help you grow your SaaS startup.

80% of bootstrapped SaaS companies have one or more developers on their founder team

When you’re bootstrapping, it’s simply a lot easier to make forward progress, keep costs low, and grow your product when you have a developer on the founder team. You can start small, be scrappy, and build an MVP (minimum viable product) or V1 of your product fast without having to hire.

Interestingly, the percentage of founders who consider themselves developers is shrinking: In 2022, only 11.8% of founders didn’t consider themselves developers as well, while in 2024, 17.7% of founders said they weren’t developers.

What changed?

This is likely driven in part due to the rise in no-code development that allows even non-technical founders to build and launch a product — without coding and without hiring development support.

In short: It’s getting easier and easier to be a founder without having a technical background, and still be able to build and launch your own product. Platforms like Bubble are leading the way in the no-code development space, but there are other no-code development platforms too, depending on your needs.

Only about 0.2% of tech startups receive VC funding

If you’re hoping to get venture capital (VC) funding for your startup, you’re not alone. Just know that VC capital is hard to get (and getting harder).

In fact, data from multiple sources — including many VC firms — shows that less than 1% of companies who seek out VC funding receive it.

Of companies that do receive VC funding, there’s been a clear frontrunner in 2024: artificial intelligence. AI-based startups and companies received 28% of all VC funding in Q2 of 2024. And 42% of all unicorns created in the first half of 2024 are AI companies.

That said, overall VC investments are down significantly, dropping below $70 billion in Q3 2024, compared to over $150 billion in Q1 of 2021.

The good news: VC funding isn’t necessary to build, launch, and grow your business. While it can be helpful, it isn’t a magic bullet for success.

30% of tech unicorns are now unprofitable in 2024

Raising VC funding for your SaaS startup is enticing, but it’s not the only — or even the best — funding option to grow your startup.

In fact, recent data suggests it might be increasingly untenable if your startup doesn’t already have a strong business model. For example: In 2021, about 5% of tech unicorns were unprofitable with declining YoY sales. In 2024, that number has risen to 30%, showing an increase in tech unicorns that ultimately aren’t succeeding.

Taking on VC funding isn’t necessarily a bad move for SaaS organizations — but striving to become a “unicorn” is less and less necessary for long-term SaaS success. What about everyone else? VC funding may not impact your annual growth rate as much as you think. A 2023 report found that early-stage ($1 million to $15 million ARR), venture-backed SaaS startups saw 42.8% YoY growth between 2022–23. Bootstrapped SaaS companies in the same stage saw 44% growth over the same period.

The takeaway: Bootstrapping isn’t right for every company — and raising VC funds isn’t a “bad move.” But bootstrapped companies tend to be more efficient with their funds, have lower customer acquisition costs, and can often navigate industry downturns more effectively as a result.

So if you’re going for growth, don’t assume raising funding is the only option. Bootstrapping your startup can lead to just as much growth.

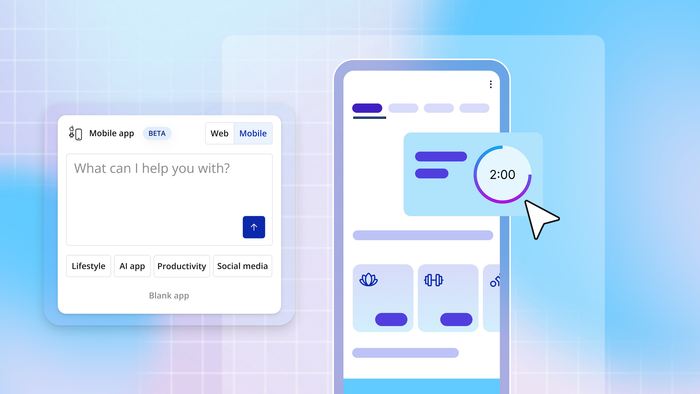

Build with Bubble

If you’re still building your SaaS tool: Bubble is here to help.

Building on Bubble makes the product development process faster, easier, and more affordable, so you can launch and grow your startup more quickly, with fewer startup costs. With Bubble, you can build anything you imagine with no-code, allowing even non-technical founders to build their app independently.

Plus, our visual, drag-and-drop editor makes building and iterating simple, so you can ship faster, without the time and cost of hiring devs.

And unlike other no-code tools, Bubble provides complete control and customization — build anything from online marketplaces to internal SaaS tools, scalable SaaS tools, AI tools, and more, all on Bubble, all with no-code.

Don’t believe us? Watch our getting started tutorial and see how simple it can be, then give it a try yourself and get started building — for free until you launch! — today.

Build for as long as you want on the Free plan. Only upgrade when you're ready to launch.

Join Bubble