At Bubble, we want to enable potential builders to create their ideas without code, so we are exploring and reviewing the many tools and software that entrepreneurs might use to build their ideas.

What is TillyPay?

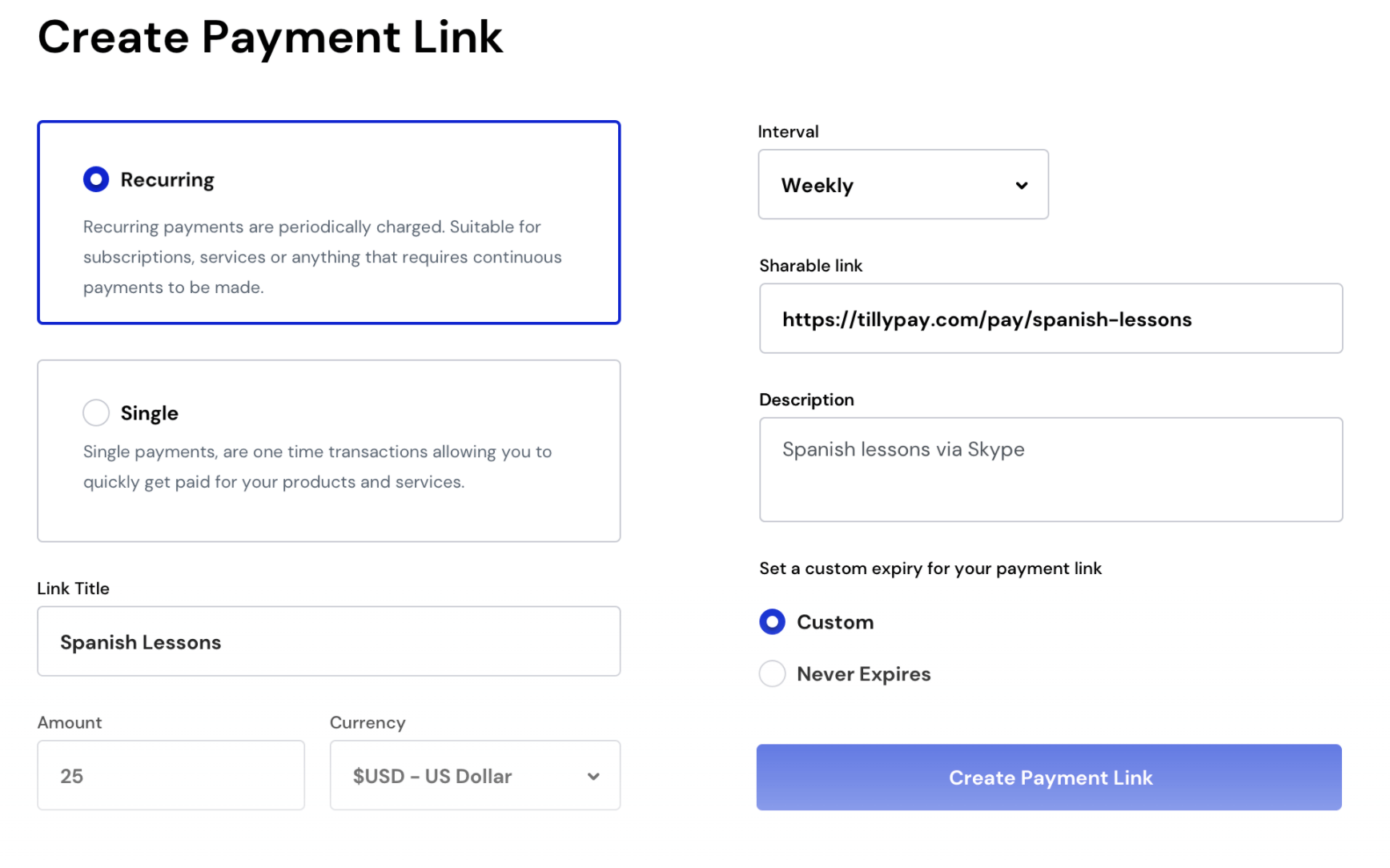

TillyPay is a Stripe-integrated payment platform that enables businesses, non-profits, and freelancers to create single or recurring payments via a web link. Links are user-friendly and easy to follow, with customers being able to pay in over 135 different currencies.

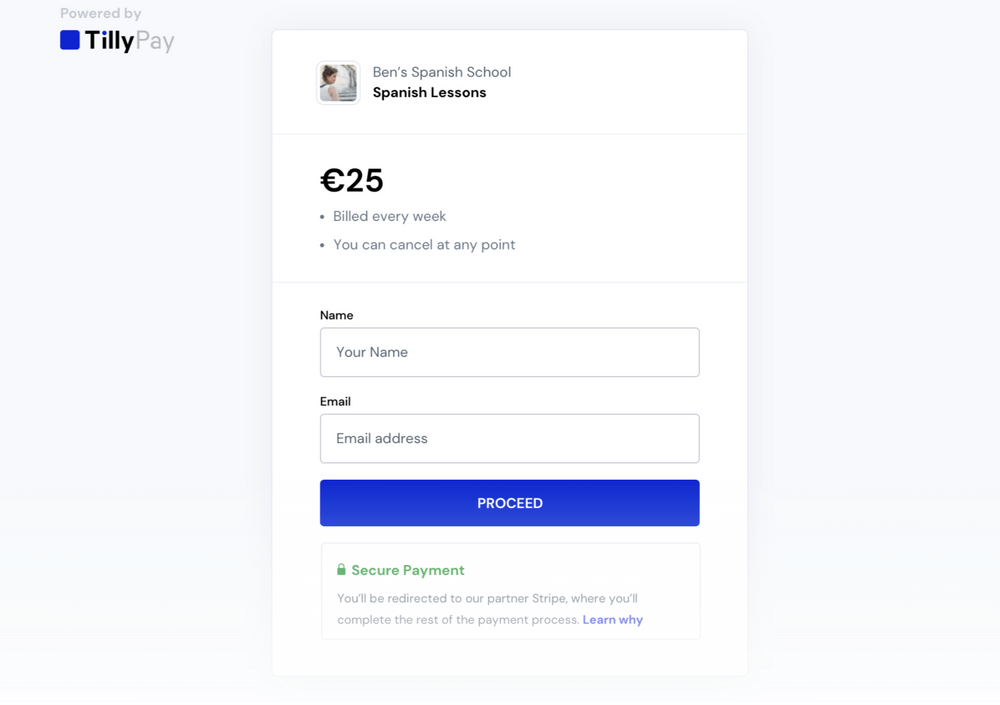

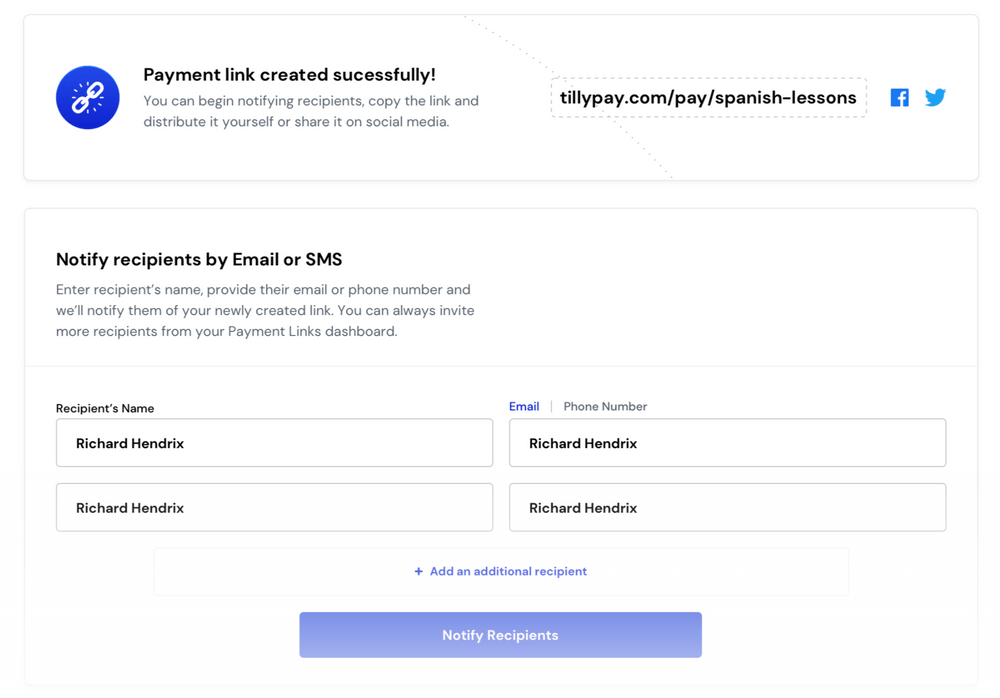

Users are able to send payment requests to their customers via email or text notification, with the option to send an unlimited amount of notifications via the payment links dashboard. Once your customers access the link, they are brought to an intuitive checkout page, where TillyPay Pro users have the option of crafting a personalized checkout. Those who use TillyPay give their customers the freedom to pay with all major credit and debit cards, with the funds transferred directly to the TillyPay user’s account.

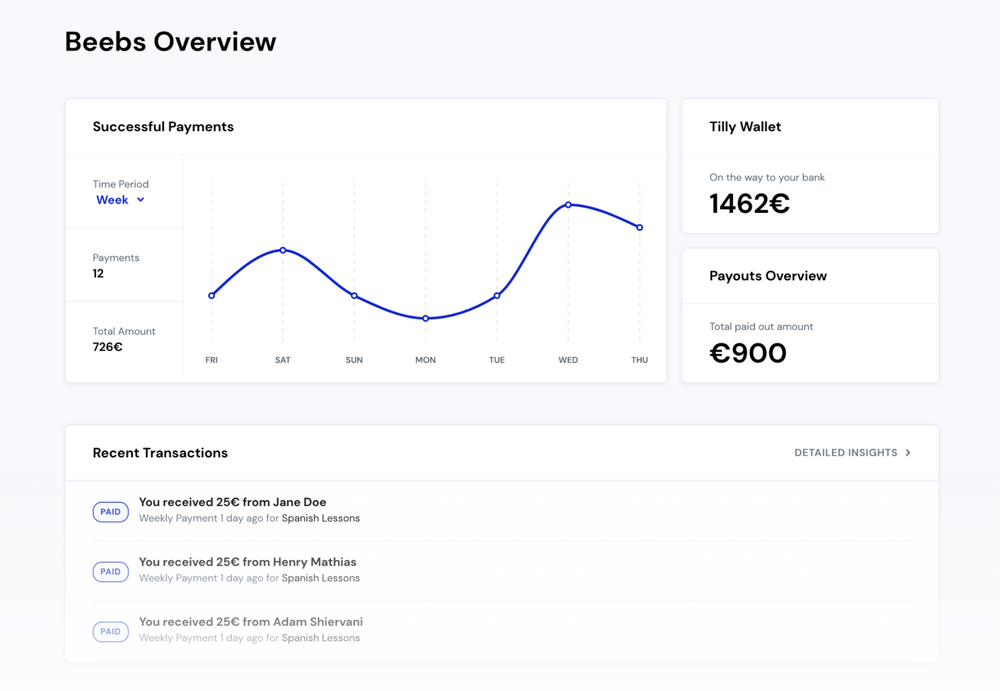

When users access the TillyPay overview page, they get insight into the performance of their different payment links and recurring charges. The platform also offers users an interactive interface that details deposit statuses, recent transactions, and upcoming payments.

Who is TillyPay for?

TillyPay can be used by a wide variety of businesses and freelancers/contractors. The platform simplifies the payments process with a web-link, offering a unique solution for businesses at all stages.

Account and client service teams can remove the hassle that is monthly invoicing, offering an intuitive and direct payment option for their customers. A major grievance for these teams is the payment process as a whole; i.e. making sure customers receive invoices, follow through on said invoices in a timely manner, etc. TillyPay aims to automate the payment process, reducing what was traditionally a heavy lift for these teams. Charities could make use of the payment tool as well, offering donors and new customers a simple way to transact with a non-profit organization.

For freelancers that offer individual services, TillyPay’s platform serves as a useful resource for tracking multiple recurring and non-recurring payments. The tool could be especially useful for educators, and creatives, and consultants.

TillyPay Cost and Pricing

(Pricing model evaluation: August 2020)

TillyPay is free to use for as long as you’d like, but there is a 2.5% transaction fee that users must agree to. At the free tier, users are afforded access to the platform's basic features, such as unlimited payment links, recurring payment options, and more. Users that sign up for the Pro plan pay $30 a month in return for no transaction fee from TillyPay. Pro users receive full access to the features that come with the free plan, in addition to a personalized checkout, custom domain and more.

One thing that potential buyers should keep in mind is that they will also be subjected to transaction fees from Stripe, the integrated payment provider. Stripe takes a 2.9% fee per successful card charge plus an additional 30 cents. International payments will also incur a 1% fee. Additional pricing details include:

Free Plan: $0/month with a 2.5% transaction fee + Stripe fees. Free plan users receive

- Unlimited Payment Links & Requests

- Recurring Payment Options

- Accept payments in 135+ currencies

- PCI Level 1 & PSD2 compliance

- Payment Notifications

Pro Plan: $40/month if paying monthly, $30/month if paying annually + Stripe fees. Pro plan users receive:

- Unlimited Payment Links & Requests

- Recurring Payment Options

- Accept payments in 135+ currencies

- PCI Level 1 & PSD2 compliance

- Payment Notifications

- Personalised Checkout

- Custom Domain

- Zapier Integration

- Process up to $/€/£ 10,000 monthly

- No TillyPay Branding

TillyPay vs. Bubble: A Comparison

How does a payment platform TillyPay compare to a no-code platform like Bubble?

The main similarities between Bubble and TillyPay include:

Both Bubble and TillyPay offer ways of creating simplified payment solutions.

Both Bubble and TillyPay are Stripe Verified partners.

Both Bubble & TillyPay offer email integration for customers.

Both Bubble and TillyPay offer educational materials for new users.

The main differences between Bubble and TillyPay are:

Objectives: TillyPay exists to simplify the payments process with no-code functionality for businesses and freelancers. While Bubble technically does the same, Bubble is a more robust no-code platform that allows users to build entire marketplaces with little to no coding experience. In terms of payment processing, Bubble also integrates with Stripe and supports complex payment models including subscriptions, deferred payments, third-party transactions, and more.

Customization Options: At TillyPay’s free tier users can get their payment link up and running and out to their clients, but they are limited in what they can do in terms of the look and feel of their web link. Bubble users have full creative control at the free level to customize the layout of their app. At Bubble, users can create a pixel-perfect web design without any knowledge of HTML or CSS.

User Base: TillyPay primarily serves businesses, NGO’s, and freelancers that work in transactional spaces; offering a simplified payment process for their clients. Bubble’s customer base expands beyond those in need of transactional services. Bubblers use our no-code platform to build social networking apps, dating websites, transportation apps, and lots more.

Alternatives to TillyPay

Alternative recurring payment processors include the following:

If you’re looking for a tool that specializes in subscription billing, check out Billsby.

If you’re looking for a service that can accommodate a wide variety of currencies, give Chargebee a try.

For businesses that want a popular tool used in large corporations, try out Recurly.

For entrepreneurs that want a simple tool to complement their online marketplace, check out Square.

About Bubble

Bubble is a leader in the no-code movement. Bubble offers a powerful point-and-click web editor and cloud hosting platform that allows users to build fully customizable web applications and workflows, ranging from simple prototypes to complex marketplaces, SaaS products, and more. Over 400,000 users are building and launching businesses on Bubble - many have gone on to participate in top accelerator programs, such as Y Combinator, and even raise $365M in venture funding. Bubble is more than just a product. We are a strong community of builders and entrepreneurs that are united by the belief that everyone should be able to create technology.

Join the no-code movement today.

Disclaimer: The goal of these reviews is to provide an honest, practical, differentiated comparison of features and educate readers on tools in the no-code ecosystem so that you can evaluate how these services fit together and serve your needs.